Here’s why a client bringing in 24k monthly might be worse than one paying us 12k, and what to do in such a situation.

Which client am I earning the most from, and which am I “contributing” to? These are questions that service businesses – marketing agencies, software houses, SaaS companies, law firms, accounting offices, and other service companies operating on a subscription or flat-rate model – should ask themselves. The key is client profitability, which answers the question: am I earning from this client? How to calculate it?

How to calculate client profitability in a subscription model?

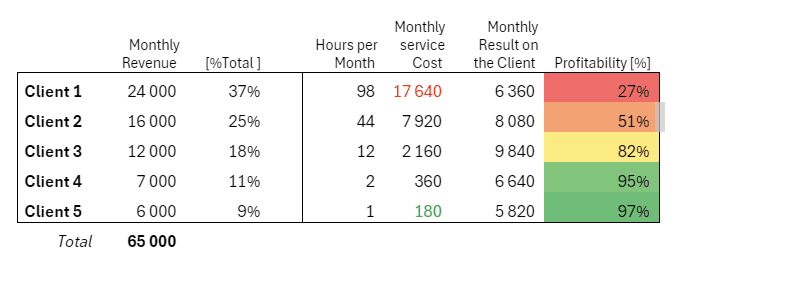

Example: A software house developed an e-commerce management program. This software is sold in a SaaS subscription model, renewed monthly or quarterly. For simplicity, let’s assume that five clients use it, generating a total monthly revenue of 65k:

At first glance, clients 1 and 2 combined generate over 60% of the company’s business, so they seem the most important. However, to assess client profitability, we must consider the cost of servicing them. What is the cost of servicing a client? In this case, the company maintains a team of consultants and developers who handle the orders of individual clients. There may also be additional costs such as IT licenses or subcontractor fees.

We need to determine how many hours company employees spend servicing each client. Knowing the labor cost of our employees (number of hours worked for a particular client × employee’s hourly rate), we got it. By subtracting these costs from each client’s revenue, we get the actual client profitability. Let’s assume we pay our employees 180 per hour:

A client generating nearly 40% of the company’s monthly revenue turns out to be its least profitable client. Why? Because the cost of servicing them, calculated by the wages of employees assigned to their service, is so high that it “eats up” a large portion of the revenue. As a result, out of 24k monthly revenue, only 6.3k of gross margin (first-degree margin) remains, which means a profitability of 27%.

Moreover, this way of calculating profitability shows that Client 3, whose subscription is “only” 12k – half the rate of the largest client – “leaves” nearly 10k of gross margin in the company, which is over 65% more!

How to improve client profitability?

The lowest profitability does not mean we should stop servicing this client. Although they engage many of our resources, stopping their service overnight would create a big revenue gap, which could threaten our company’s financial situation.

So what can we do to improve profitability?:

- Negotiate rates. If we are confident the client will stay with us, we can quickly increase their profitability by raising the subscription fee without increasing service costs.

- Verify service costs. Hey, maybe the problem isn’t with the client? Let’s check why our consultants and developers spend so much time servicing the least profitable client. Are they correctly “assigning” hours worked to clients? There may be inefficiencies in the team’s work that can be improved, and the “saved” employee time can be used to service new clients. This way, we will improve client profitability and increase the profitability of the whole company.

- Stop servicing unprofitable clients. In extreme cases, it may turn out that the cost of servicing a client is higher than the revenue. Sometimes the best solution for a company is to end cooperation with such a client. However, in this case, improving company profitability will require either reducing our resources (lowering costs while losing a small amount of revenue) or replacing unprofitable clients with ones we can earn from.

- Change the internal client service model. I have seen cases where companies prioritized servicing the largest clients in terms of revenue, without looking at their profitability. This can lead to the loss of the most profitable clients, who, feeling dissatisfied with the quality of service, will leave. That is, Client 3 quits our services because they don’t feel adequately “cared for”, while we focus on Client 1.

- Restructure the client portfolio. Regularly examining profitability helps determine which clients are the best for us and how to keep them in the company, as well as attract similar clients from the market.

The biggest impact will come from doing this on regular basis. If we regularly measure the profitability of each client, we will be able to monitor the trend. It is worth doing this, for example, quarterly or monthly. This way, we can respond on an ongoing basis, taking care of our client portfolio and the company’s overall performance.