If you’re building a startup, sooner or later you’ll come across the term “cap table.” What is a cap table? It’s simply a spreadsheet showing who owns how many shares in your company. Sounds simple? That’s because, at the beginning, it usually is. But later, when investors come in, employee stock options (ESOP – a program that makes employees co-owners of the company, allowing them to share in its success), and additional funding rounds appear – things start to get complicated. That’s why it’s worth understanding the cap table right at the very start of your entrepreneurial journey. Let’s break it down in simple terms.

So, What Exactly Is a Cap Table?

A cap table (full name: capitalization table) is a tool that shows: who owns shares or equity, exactly how many they hold, what percentage of the company that represents, what types of shares there are (e.g., common or preferred), how many shares are reserved for the future (for example, for employees under an ESOP), and how all of this changes after each investment round. In other words, it’s like a map that illustrates how the company is divided and how that division evolves over time.

Why Do You Need a Cap Table? Here Are Four Reasons:

- Transparency for Investors

Heads up! VCs, angel investors, or funds won’t join your company blindly. Before they put in any money, they want to know who holds shares and how many are left. You need to provide them with clear, transparent data.

- Controlling Dilution

New shares = a smaller percentage for existing shareholders. A cap table helps you keep track of how much ownership is being diluted.

- An ESOP Without the Chaos

Want to reward your team with equity? Great. But you need to plan it in advance. A cap table lets you figure out how many shares you can allocate without giving away too much of the company.

- Knowing the Real Value of Your Stake

Your % of ownership × the company’s valuation = the actual value of your stake.

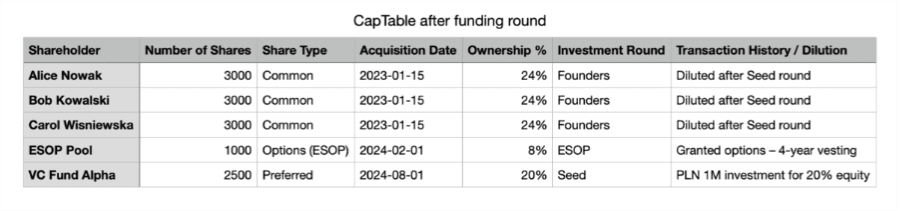

What Should a Well-Maintained Cap Table Include?

It should definitely contain: the names and details of shareholders, the number of shares they hold, the type of shares (common, preferred, options), the date the shares were acquired, the percentage of ownership, details of investment rounds, and a record of transactions and dilution history.

Cap table in practice – a simple example

Let’s say you’re starting a startup with two other people: Alicja and Bartek. In this scenario, you’re Celina (please use your imagination). You split the company evenly:

Each of you holds 3,000 shares, for a total of 9,000 shares = 90% of the company.

You also create an ESOP pool of 1,000 shares (10%) to reward future team members.

So before any investment:

- Founders: 90%

- ESOP: 10%

Then an investor comes in: VC fund Alpha invests 1 million PLN for 20% of the company.

What happens? You issue new shares.

The cap table now looks different:

- Alicja, Bartek, and Celina (that’s you in this case) now each hold 24%, for a total of 72%.

- ESOP drops to 8%.

- VC Alpha gets 20%.

The founders’ ownership percentage goes down, but the company is now worth more – so their slice of the pie is smaller… but tastier. Why?

Because! This is important: even though the founders’ percentage shrinks, the value of their shares increases, since the company’s valuation goes up after the investment.

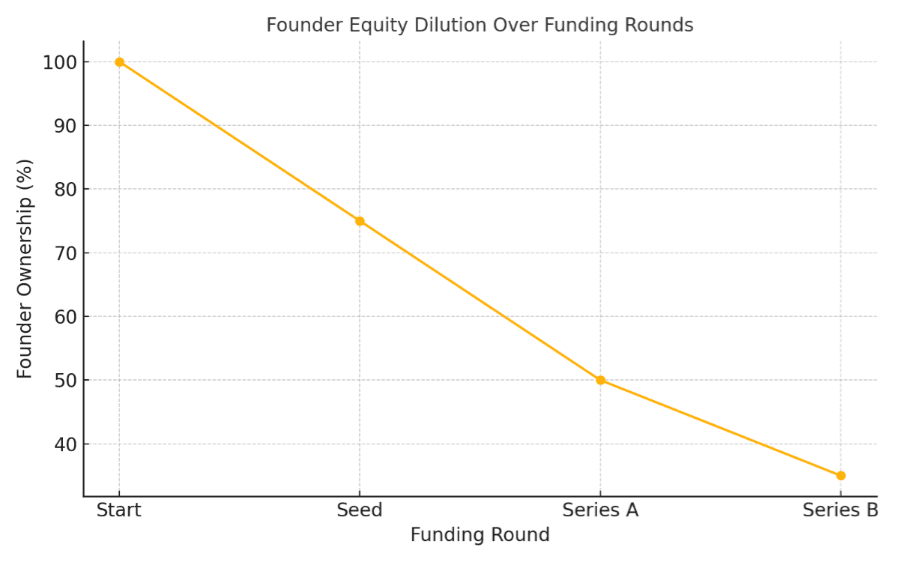

What does dilution look like over time?

You can’t avoid it – but you can (and should) manage it carefully.

Example of dilution:

- Start – Founders: 100%

- Seed round – ~75%

- Series A – ~50%

- Series B – ~35%

And again! That’s perfectly OK – if the company is growing, the value of your smaller slice is still increasing.

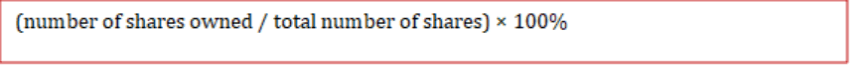

How to Calculate the Ownership Percentage for a Cap Table?

Here’s a simple formula:

Example (you get to be Celina again):

You own 3,333 shares, and the company has 12,500 shares in total.

Your ownership: (3,333 / 12,500) × 100% = 26.67%.

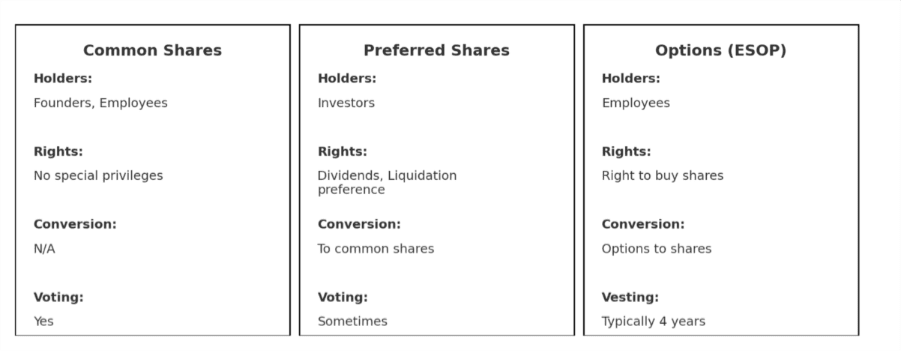

Types of shares – what should you watch out for?

- Common shares – typically for founders and employees. No special privileges.

- Preferred shares – usually for investors. They come with perks, like liquidation preference in the event of a company sale.

- Options (ESOP) – a form of employee incentive. They don’t grant ownership immediately – employees need to “earn” them over time (this is called vesting).

What Are the Risks of a Poorly Managed Cap Table?

If you forget to add a new investor, the numbers won’t add up, don’t plan for an ESOP, you’ll later have no shares left to allocate. If you give away too much in the first round, you’ll be left with only a small slice of your own company. If you don’t calculate the fully diluted view, you might be caught off guard when all options convert into shares.The result? Chaos and unpleasant consequences. But remember – this can be managed. Plus, you can always rely on technology to help you keep things under control.

What Tools Are Worth Knowing to Manage a Cap Table Efficiently?

These can help:

- Google Sheets / Excel – Perfect for early-stage startups

- Captable.io – Free tool with great visuals and cap table templates

The Three Most Common Cap Table Mistakes Founders Make – and How to Avoid Them

- Not Updating the Cap Table After Issuing New Shares – make sure to apply regular updates so your numbers always reflect the current ownership structure.

- No ESOP Plan from the Start – plan at least a portion of potential future shares for employee stock options early on, so you’re not caught unprepared later.

- Ignoring the Fully Diluted View – the broader the perspective, the greater your awareness. Always keep an eye on the fully diluted cap table to understand the real impact of dilution.

To sum it up…

A cap table isn’t just a boring spreadsheet for your accountant – it’s the map of your company. It shows who owns what, how much it’s worth, and how things change with each investment.

Start managing your cap table from day one. Even if it’s just you and a co-founder now – soon enough there’ll be investors, a team, options… and that one table will become one of your most important documents.

At incro, we help service-based businesses bring order to financial chaos. Our experts combine controlling, business intelligence, and strategy – acting as your external finance team.

Questions?

💬 Book a free consultation: https://incro.us/contact/