n

Here is why every business should consider forecasting its financial result and how it can prevent a well-functioning company from getting into trouble.

From the article, you will learn that:

- Forecasting the company’s result is easy.

- The forecast should include fixed and variable costs.

- Forgetting about investment expenses can significantly distort the forecast.

- You should forecast regularly, feeding the model with good data.

- Don’t lose your focus; a profitability forecast is not a cash flow forecast!

Forecasting the company’s result is easy

In simplest terms, you need to estimate the company’s annual fixed costs, determine the year-to-date revenue, and add planned revenue, e.g., based on CRM or information from the Sales Department. The sum of revenue minus the sum of costs gives a simplified pre-tax result.

Include fixed and variable costs in the forecast

Include fixed and variable costs in the forecast

If in your business model revenue always come with additional expenses, e.g., a new client is served by a partner on a B2B contract who will invoice you for this service, you must also include these costs in the forecast.

Failing to include investment expenses can distort the forecast

Failing to include investment expenses can distort the forecast

If you don’t have a financial plan but know that you will have investment (CAPEX) or maintenance (OPEX) expenses, it’s worth including them in the forecast. This will help avoid unpleasant surprises at the end of the year when you realize that the result is lower than expected.

Forecast cyclically

Forecast cyclically

It’s beneficial to regularly refresh the forecast, to maintain its greatest value. For highly profitable and fast-growing businesses, regularly updating the forecast will allow you to spot threats well in advance, such as declining profitability, lower sales dynamics, or rising costs. For companies with financial difficulties, forecasting enables creating a recovery plan, e.g., regular work with the Sales Department, based on numbers.

A profitability forecast is not a cash flow forecast

A profitability forecast is not a cash flow forecast

A result calculated as profitability is not the same as the cash in your company’s accounts. Thanks to the forecast, you can check if the company will meet its annual plan, but you must manage and forecast cash flow separately.

What is and what isn’t forecasting?

What is and what isn’t forecasting?

A company result forecast is a profitability account that tells you where the company stands at a given moment. Such an account can be quite simple or highly detailed – in the case of an advanced forecasting model.

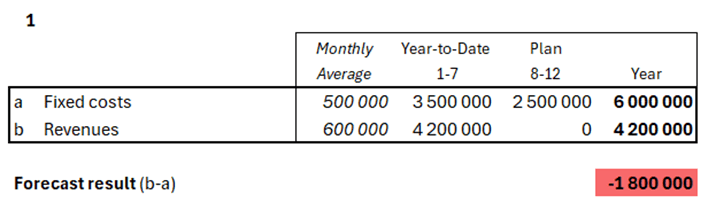

For example, the annual fixed costs of running the company, meaning it “stands still” and sells nothing, are6 million. Knowing that by the end of July we have achieved sales of 4.2 million and have no additional planned sales until the end of the year, the year’s forecast is: revenue from January to July 4.2 million minus 6 million costs until the end of the year = -1.8 million. We are underwater for now.

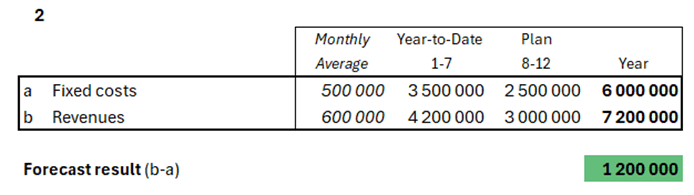

In the same scenario, if we know that in the sales funnel for the August-December period we have planned sales totaling 3 million, the forecast result for the year is: achieved revenue 4.2 million plus planned revenue 3 million minus 6 million fixed costs until the end of the year = 1.2 million. The planned pre-tax result is 1.2 million.

Such a revenue forecast based on the sales funnel can be nuanced. From the Sales Department, we know that 70% of planned revenue until the end of the year are “certain” projects, while the remaining 30% are sales opportunities with probability between 50%-80%. We can include this in the forecast. We also get a valuable tool for cyclical work with the Sales Department, e.g., a monthly business review where we check the progress in acquiring and closing sales opportunities.

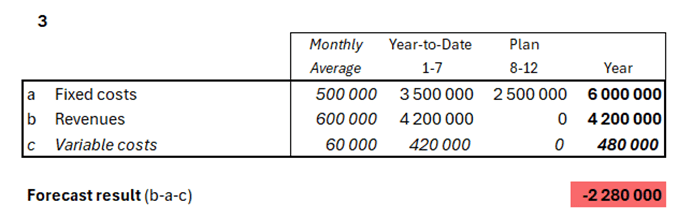

We can conduct a similar account if the company’s revenue always result in additional costs. Let’s assume that the company mentioned above, on average, incurs 10% variable costs, meaning it pays 10,000 to subcontractors for every 100,000 in revenue.

This means that the forecast annual result at the end of July, without additional sales in the August-December period, is: achieved revenue 4.2 million minus variable costs 0.42 million minus annual fixed costs 6 million = -2.28 million PLN. We are in a significant deficit.

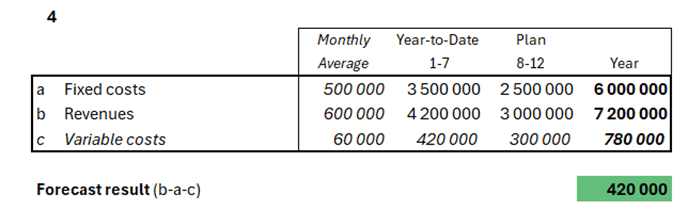

If we know that in the sales funnel for the August-December period we have another 3 million in planned revenue, and the costs associated with obtaining this revenue will be 0.3 million, the forecast result until the end of the year = 0.42 million pre-tax.

And what isn’t forecasting the result?:

- A forecast is not a financial plan. We can compare the forecast to the plan and see how far or close we are from achieving it.

- A company’s profit forecast is also not a cash flow projection. Greatly functioning companies with a good business model and high profitability were able to go bankrupt because they failed to timely execute overdue payments from their customers and as a result lost liquidity.

Does your company need a forecast of the financial result?

Does your company need a forecast of the financial result?

It depends, but probably yes. And if you don’t forecast the company’s result, sooner or later you will start doing so. Why?:

- For smaller businesses, if you keep an eye on profitability and the company has large surpluses, a forecast is a nice to have.

- The need for forecasting will arise when you scale up your business. Then you may be faced with a data crisis, for example, you will not know what in the company you are making money on, and what is simply burning through money. As a result, with a decline in revenue and low fixed cost elasticity, you can quickly lose liquidity.

In what situations will you forecast the result easily, and when will you have to work harder?

In what situations will you forecast the result easily, and when will you have to work harder?

A service company’s result forecast will depend on its business model.

- If you have a relatively stable monthly or annual cost, and revenue don’t come with additional costs, you will easily prepare the forecast, similar to examples 1 and 2 above.

- If each new order requires additional costs, forecasting will be more complex, similar to examples 3 and 4. Pay particular attention to whether each project or order has a similar percentage of variable costs. If so, you can work on averages when forecasting, e.g., assuming that each 100,000 in revenue will involve an additional 10% cost. However, if each new project varies significantly in terms of costs, you will need to consider this when forecasting.

- A more complex forecasting model that includes more source data will always be more accurate than a simple revenue and cost account, but it will be crucial to feed it regularly with accurate data. Even the best model will give wrong results with poor-quality source data.

In summary:

In summary:

- Any forecast made will be better than no forecast.

- Forecasting does not have to be right on the spot. Forecasting is not meant to be an art for art’s sake, consuming a lot of time. It is supposed to help you determine what the company’s result will be by the end of the year.

- The greatest value will come from cyclically refreshing the forecast, e.g., every month. This way, you will observe trends and assess whether the business is heading in the right direction.